A subset of business performance management (BPM) is financial planning – also known as planning, budgeting and forecasting. In financial planning, business managers and controllers compile data from their business units, make forecasts about potential developments in the markets and formulate a plan to shape the company's future.

Every plan is wrong, but without planning, the future is mere chance, because it lacks active design. The planning process is primarily a communication process in which a company develops a shared understanding of the future, sets goals and agrees on a rough roadmap for how to achieve those goals.

Corporate plans always relate to a specific period, usually the coming fiscal year, which is broken down into twelve months. The corporate plan is then the yardstick for actual development. It provides guidance on the question: Are we on the right track in terms of direction and speed?

1. High stakes

When resources are allocated, important decisions are made about the next fiscal year. Usually with high risk and impact also on subsequent years.

2. Highly political

It's about power. Who gets how much? Which project must take a back seat, which department gets to accelerate? Resources are always scarce and their distribution is fiercely contested, even in growth phases. Even when resources increase for everyone, they rarely do so in the same proportion. Decisions that advance the company as a whole can mean tough cuts for individual operating units.

3. High effort – extremely resource-intensive

Data collection, decisions on future direction, communication and adjustment of individual plans into a coherent plan across departments and hierarchies – all this in several iterations in addition to day-to-day operations? Takes time, energy and nerves!

That is why annual plans continue to be forged, even though the environment in which companies operate is becoming increasingly dynamic and volatile.

On the one hand, annual planning is firmly anchored in executives' annual calendars; on the other hand, it would completely bog down most companies to perform the planning feat monthly in the form that is customary today. Characteristics such as depth of detail, speed and framework conditions change, but corporate plans are here to stay, even though it would be necessary to look at the numbers more frequently.

However, this balancing act can be achieved.

With the right controlling software, which optimally supports the planning cycle, the correct business figures are available at any time during the year to recognize opportunities and risks on the market, to make course corrections – and to do so without getting bogged down between obtaining figures and distribution battles.

Planning can be viewed from three different angles:

The duration of planning horizons varies depending on the company, market and business model. What is true for all is that volatility is increasing. The annual plan used to be fixed in cement; today, it is obsolete as soon as it is completed. But broadly speaking, time-based planning can be divided into three groups. Everything under one year is operational business.

a) Long-term planning: The strategic plan beyond 5 years

This is the time horizon with the greatest uncertainty, which is why only the very broad lines and few details are recorded. In many companies, this form of corporate planning does not take place at all.

b) Medium-term planning: approx. 3-5 years

The more stable the business model, the longer the time horizon of the medium-term plan. Here, the company tries to develop a common understanding of what the next periods will look like.

c) Annual planning: budget planning

In the annual planning – broken down into quarters and months – decisions are made based on: What do we want to do in the next fiscal year? What measures do we want to implement?

Here, the period coincides with the legal obligation to submit an annual report. Investors or banks, for example, measure the company against its annual plan. The comparison is much easier if planning and reporting follow the same business-oriented structure.

Forecasting: Looking into the future based on actual data

Controllers usually prepare this part of the planning process independently, evaluate data and proactively approach the business unit managers for updates and clarifications. Planning and forecasting focus on the future.

The essential characteristic of forecasting is that it is a combination of actual and future data.

If the annual result is projected, the quarterly forecast in the 3+9 format takes three months of actual figures and compares the existing planned figures for the further nine months with the assumed business development. The future figures are adjusted accordingly. In the past, this process was usually carried out on a quarterly basis, but in today's volatile environment, monthly forecasting is increasingly becoming the norm.

Why is management so reluctant to talk about budgets? False incentives. A budget is money that you are allowed to spend. Instead, many companies rely on proposing measures that are approved if they make sense.

In this type of planning, a distinction is made according to the organizational unit. Depending on the company, these can be business units, segments, or departments.

Each organizational unit makes a plan. For example, the production department makes a production plan and the sales department makes a sales plan, whereby functional and organizational elements are included.

Sales planning contains the planning of actual sales, revenue planning, etc. on a functional level and cost and personnel planning, etc. on a departmental level.

Thus, organizational planning has a lot of overlap with functional planning. The plans of the individual organizational units must then be aggregated and analyzed to see if they fit together.

From a functional perspective, detail plans such as the following might be differentiated:

If these individual plans interlock at their interfaces, it’s a considerable acceleration factor for the complete planning process. Most of the time, they don’t.

Companies that manage to achieve integrated financial planning (IFP) have a significant competitive advantage in the market.

How can this be achieved?

In financial planning, the leadership and the individual business units must come to a mutual agreement. This counter-current procedure is always an iterative process. The only question is: Who starts?

Most companies approach the planning cycle in a sequence that starts with the functional units and focuses on the main constraining factor.

In healthcare, this may be the number of beds or the available nursing staff; in software companies with a SaaS business model and minimal marginal costs, sales may be the limiting factor; and at a chocolate factory, the capacity limits of production may be the bottleneck.

Let's assume that the sales department is managed according to contribution margins and sees itself in a position to sell twice as much chocolate in the coming year as in the previous year, even though production was already operating at 80 percent capacity.

The question then arises as to how confident the sales department is about its chances and whether this justifies the investment in a new production line, more staff and the expansion of shift operation, or whether production capacity should be bought in externally.

Production is taking a risk with the investments – risk analysis and profitability calculation for the project are therefore indispensable. If the sales department then increases sales by only 10 percent, the entire company has a problem.

Production and sales must therefore work toward the same goals and address differences: Can it really be that sales is selling twice as much? Is that plausible?

This way, the business plan is negotiated several times from all sides until it is consistent.

This also applies to the definition of what actually constitutes a product. What is sold as one product by sales could be created from five components in production. Three are produced in-house, two are bought in.

The path to integrated financial planning is primarily an iterative communication process, which can be radically simplified by a software solution with consistent data.

If figures from production planning can be directly applied to the scenarios from sales planning, then sales targets including production costs are transparent.

It is then immediately obvious whether the contribution margins provide the right incentives for sales or not.

Companies that rely on Excel during the planning process typically only manage one iteration – with many remaining discrepancies that should actually be resolved.

On the way to integrated financial planning, the top-down approach has the advantage that management has the big picture in mind and the harmonization of the various sub-plans is considered from the outset. This reduces the number of coordinating loops and shortens the process.

The counter-current method compensates for the disadvantage that the management level is less able to assess opportunities and risks within the individual business units than the divisional managers. Ultimately, the stakeholders at the operational level have their say next and can take corrective action.

The hope in the bottom-up process is often that conflicts in planning will not arise in the first place, provided the plans come together as a whole. In the bottom-up process, each planner defines the resources he or she needs and the output that can be generated from them. Depending on the corporate culture and the personality of the planner, this planning tends to be more aggressive or more conservative, having sometimes more, sometimes less of a buffer.

The aggregated result from all individual plans may then not match, the overall result may not correspond to management's expectations, or the required resources (money and/or employees) may not be available as a consequence.

The efficient sequence is therefore: first top-down, then bottom-up. In this way, the bottom-up planner plans with a clear objective, verifies the feasibility of the plan, and provides constructive feedback to management. Buffers are avoided and the buy-in of the planners is still ensured.

A software-based planning system must alleviate all the pain points described above. It must be immediately clear what the adjustments to the plans in one business unit mean for dependent departments and for the overall planning process. This transparency is the factual basis for decisions.

Many discussions become instantly superfluous when there is clarity about the effects at the push of a button. Plus, arguing about remaining issues becomes much more fruitful and constructive if everyone at the table trusts the numbers.

Because they can. Controllers know Excel and don't need to rely on anyone else to do it. No IT, no external consulting, nothing. And even if it takes all day to adapt the planning to the demands of management, the 26th tab with dependent cells is built and half the night is spent tracking down that one error in that one particular Excel formula – at the end of the day, the result is there. Each time a work of art. Each time paid with even darker shaded eye rings.

Why do this to yourself voluntarily? Planning tools often create dependency on IT. Every adjustment means a change request where no one can predict when it will make it onto the roadmap. Or controllers are suddenly dependent on external consultants who build or prepare a solution but are neither cheap nor available for ad hoc changes.

No matter how thoughtful and early you get into the planning process: Management will always have change requests – right in the middle of the planning phase.

Only during the planning process itself do individual strands of information crystallize into one picture. Only now can leadership delve into the subject in depth. And that is a good thing. Only when modelling scenarios and weighing impacts is easy, sensible decisions can be made. No alignment iteration should be dropped just because implementation with the planning tool is too time-consuming.

Whoever is responsible for planning must be able to change and adapt the system independently. Controllers must be able to master their planning tool in their sleep. Then change requests are not a horror scenario, not a messed-up weekend, but a simple to-do.

That is why the introduction of a planning tool must include coaching for autonomy as early as the first project phase. After the first implementation step, controllers must be able to operate autonomously with the tool and configure the system according to their own needs – again and again, because requirements will change.

When crisis mode becomes the norm, traditional methods and technologies are no longer enough. Companies must renew the shaping of the future in the form of planning and forecasting more frequently and in even shorter cycles. Fewer resources are available for this at the management level and in the specialist departments.

Controlling, with its coordinating function, already has a variety of additional tasks. Quality, accuracy and speed in planning play the main business-critical role, especially in uncertain times.

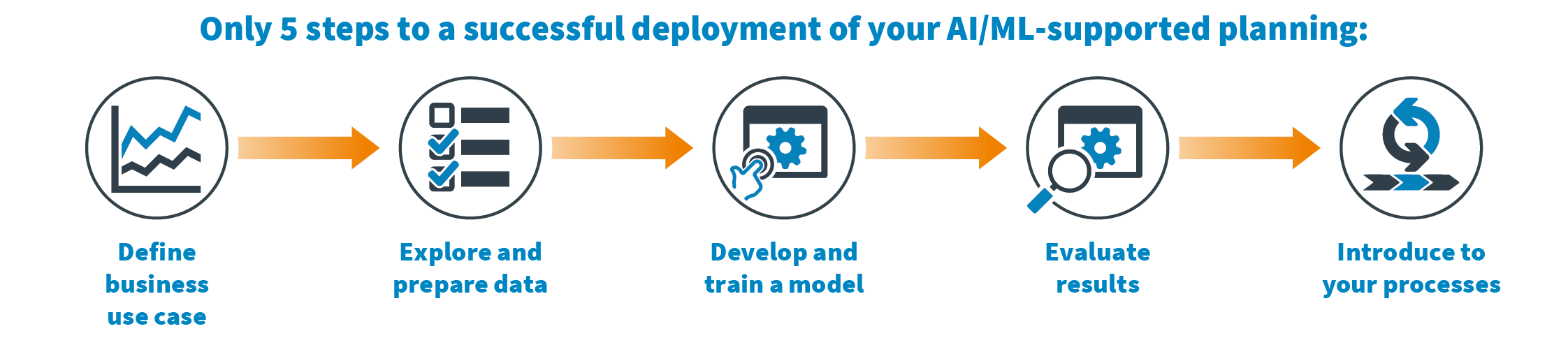

Artificial Intelligence (AI) and Machine Learning (ML), used correctly, have the potential to bridge the gap between greatly increased planning needs and reduced resource availability. In the process, recurring routine tasks are automated with the help of AI and ML, so that the controlling team can focus on more important tasks and analyses.

However, many controlling departments are still hesitant about the use of artificial intelligence and machine learning - the advantages are too vague, and the costs are estimated to be too high. The advantages of AI/ML-powered predictive planning are obvious:

1) Set up automated planning support

2) Further develop analyses

3) Improve data quality

4) Design scenario simulations

Are you looking for the financial planning software that frees your budgeting and forecasting processes from complexity and reliably delivers consistent business figures? Then try Serviceware Performance and benefit from a successful corporate performance management tool with state-of-the-art planning and analytics.

Online demo

Book a personalized demo with our expert consultants today to see what our solutions can do for you.